Accounting and Journal Entry for Sales Returns With Example

The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the revenue account from the initial purchase. You must debit the Sales Returns and Allowances account to show a decrease in revenue. See the entries below on how to record the goods returned by customers into the inventories and how it is affected the cost of goods sold. The journal entry to record this transaction is to Debit Payables, and Credit Purchase Returns.

Returns Outward: Explanation

In this case, the “sales returns and allowances” account is required for recording such transactions. Sales returns and allowances account is the contra account to sale revenues. Credit The goods are returned and the asset of inventory decreases. The credit to purchase returns reduces the value of purchases and at the end of the accounting period, will reduce the purchases debited to the income statement.

Are sales returns and allowances an expense?

If goods are returned to a supplier, or if an invoice received from the supplier has an overcharge, a credit note would be sought to rectify the situation. We use the perpetual inventory system in our business in order to manage and control the flow of the inventory goods in the accounting record. This entry is made when a customer notifies the business that they will return the merchandise.

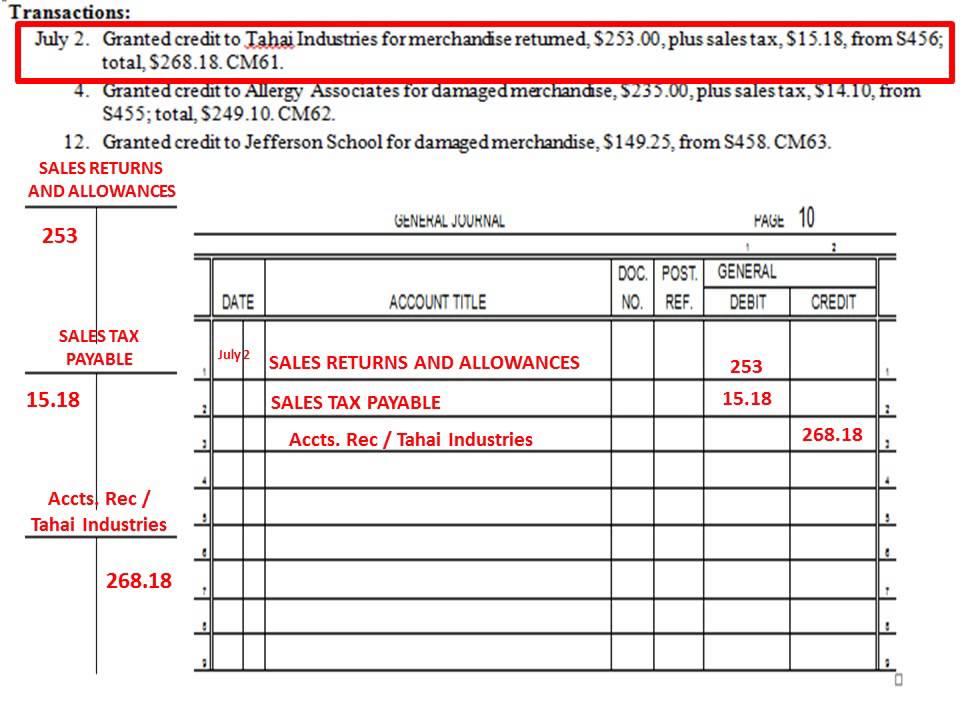

Journal Entry for a Sales Return

On Feb 5, journal entry to record the sales return and the buyer’s account adjustment. Firstly, there is a need to debit account payables and credit purchase returns. It can be seen that Debiting Payables is a reduction in liability, whereas crediting purchase returns is a decrease in expense.

- They are goods that were once purchased from external parties, however, because of being unsatisfactory they were returned back to them, they are also called Purchase returns.

- We use the perpetual inventory system in our business in order to manage and control the flow of the inventory goods in the accounting record.

- Post an accounting entry for sales returns in the books of Unreal Corporation.

- The receivable from Club B was outstanding as at the end of July, when Club A returned 5 and Club B returned 10 footballs.

It involves adjusting both the revenue and inventory accounts to accurately represent the return transaction. Return inwards or sales returns are shown in the trading account as an adjustment (reduction) from the total sales for an accounting period. A purchase return, or sales return, is when a customer brings back a product they bought from a business, either for a refund or exchange.

Return of Merchandise Sold for Cash

However, a customer may find that low-quality (or slightly damaged) goods can be resold at a lower price or they can be used elsewhere. Since this is the credit sales, the company needs to account for the account receivable by debit in the amount of USD875 and credit to sale account USD500 and USD375 and giving the total of USD875. The Debit Balance will then offset this credit balance in the Purchase Account. In this blog post, we’ll delve into the depths of returned merchandise journal entries, breaking down the process step by step to demystify this essential aspect of accounting.

If the return is due to a change of mind, the item should be inspected for signs of wear and tear. A decision can then be made about whether to offer a refund, exchange, or store credit. Retailers across the globe expect a certain percentage of purchased items to be returned. Most returns are handled quickly and efficiently, but some can be problematic. These are usually due to damaged goods, incorrect items, or missing parts. Whatever the reason for the return, businesses must have a plan in place to handle them.

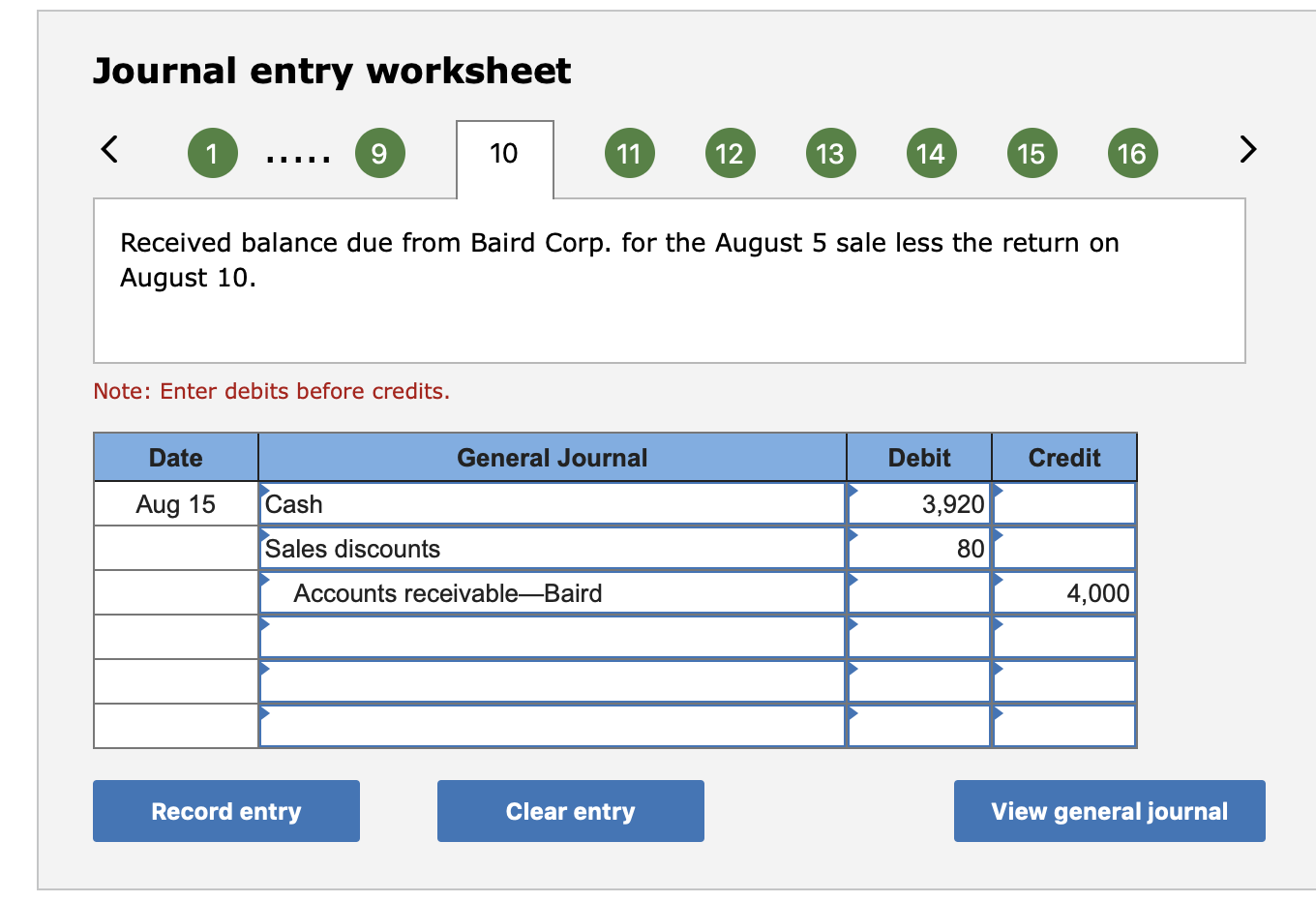

Either cash sale or credit, we need to reduce cash or account receivable accounts and reduce the revenues. Accounting for sales return is mainly concerned with revising revenue and cost of goods sold previously recorded. how to create open office invoices with freshbooks Account receivable or cash and cash equivalents should also affect whether it is the cash sale or credit sales. When a customer returns something they paid for with credit, your Accounts Receivable account decreases.

However, the company still need to make allowance for such transactions in their accounting system. The company allows the customer to return the goods if they are not satisfied. All credit notes received from the supplier are entered in the returns outward book. The entries are listed in more or less the same manner as invoices received are entered in the purchases book. Customers are normally entitled to return the products they purchase from a company when they are not satisfied, usually within a specified duration after the sale. When a sales return occurs, the customer physically returns the product and receives his cash back.

The company passes Purchase Return Journal Entry to record the return transaction of the merchandise purchased from the supplier. When merchandise purchased for cash is returned, it is necessary to make two journal entries. The first entry debits the accounts receivable account and credits the purchase returns and allowances account. The second entry debits the cash account and credits the accounts receivable account.

In the case of purchase returns, it can be seen that goods are returned to the supplier and subsequently recorded in General Ledger under the account of Purchase Returns. The company may grant a reduction of the purchase price to customers so that customers can keep the goods. In this case, the customers do not need to return goods back to the company.